Stage 1 – Collect the facts

The first stage is really just about collecting the facts. It is not about being a good analyst or doing some complex intrinsic valuation calculation and unearthing some unknown insight. It is the grunt work that any research analyst or fund manager would do as step one. It takes a bit of time, but it gets quicker the more you do it (depending on how serious the decision is). For a large fund manager taking a big stake in a small stock (a big punt) this process would be far more in-depth than for a retail investor having a quick trade.

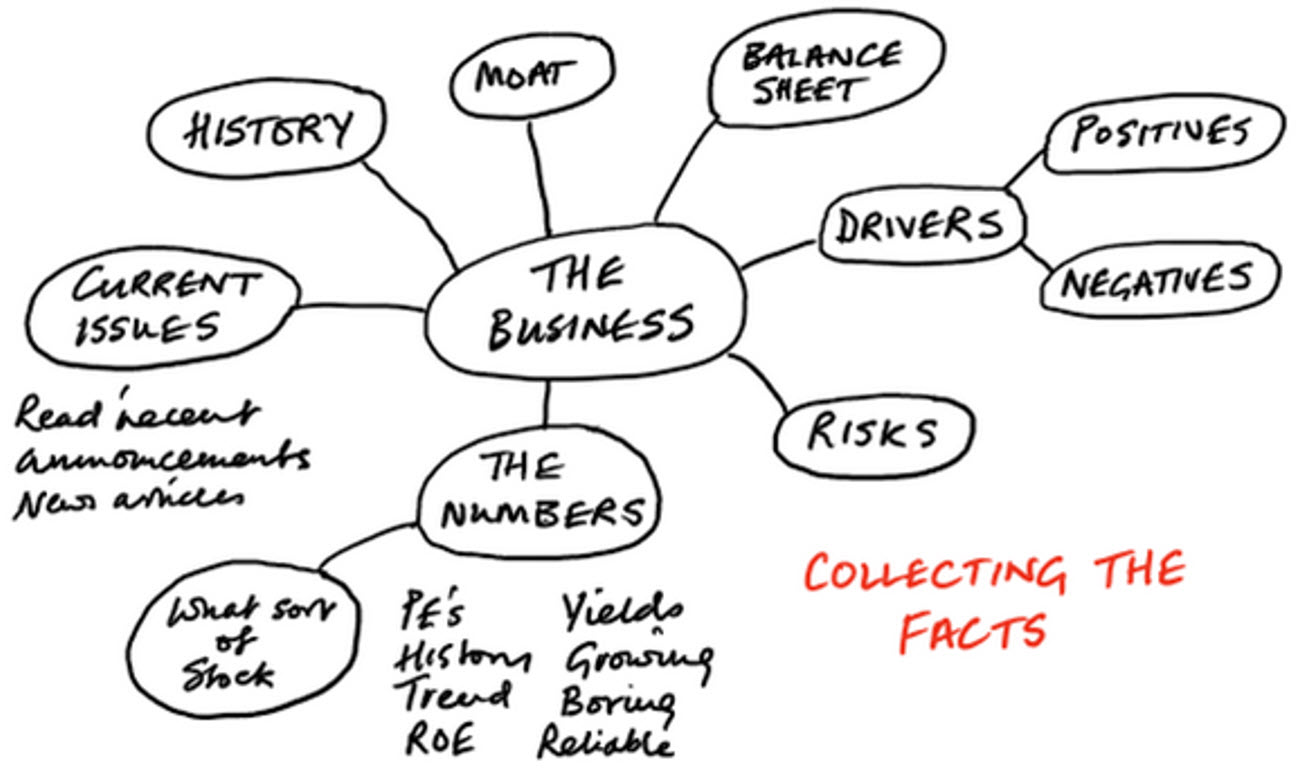

This is the first brick in the wall, the first part of the process, collecting the facts and putting yourself above everyone who doesn’t bother and on a par with anyone that has an investment process. The image below displays the elements of this part of the process.

This is where you want to end up writing in a big texta “Crappy stock with no fundamentals” or “Big quality stock with long term growth prospects”. This is where fund managers go and visit a company but for you a lot of that factual stuff is already online on the company’s website. You’ll find corporate videos, company presentations, all sorts of things.

You do not at this stage write “Cheap” or “Expensive”. It is the nature of the investment rather than the state of the share price you are trying to define.

Unfortunately, this is where a lot of people end their research, in some grand declaration that if it is a “Quality stock” it must be a “BUY”. But your process can be a little bit better than that.

Having determined the nature/risk of a stock the next step is to collect the “ADDED VALUE”.