Golden Cross/Death Cross

What is a Golden Cross?

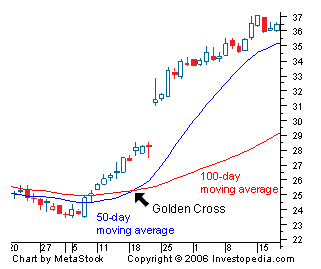

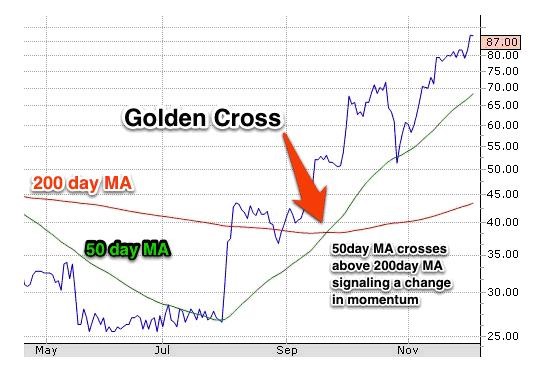

This is a bullish signal when the short term 50-day moving average moves above the long term 200- day average.

The theory goes that the long term indicator adds more weight but the short term trading patterns give traders a clue to an upcoming bull trend.

The three stages to a Golden Cross

- Downtrend bottoms as selling exhausted.

- The short term Moving Average (MA) forms a crossover with the longer-term average providing a trigger to the upcoming breakout.

- The uptrend continues with a follow-through of higher prices.

The MA act as support levels on any pullback until they cross back below the short term average again and this is known as a ‘Death Cross’.

Most chartists will use a 50-day MA as the short time period coupled with a 200-day MA. This is one of the most popular set ups as it predicts longer lasting breakouts.

If you are day trading, you may well use far smaller periods especially in fast moving markets like FX. It may be appropriate to use 5-day and 15-day MA but these trends will be far shorter in duration and will lead to increased volatility.

Generally choosing a longer short term and a far longer long term will give signals of longer periods of bullishness.

Golden Cross breakout signals can be utilised with various momentum oscillators like stochastic, moving average convergence divergence (MACD) and relative strength index (RSI) to track when the uptrend is overbought and oversold. This helps to spot ideal entries and exits.

There is a possibility that if the 50-day MA moves up too quickly and is much higher than the long term MA then the stock may be overbought in the short term and a pullback could be expected.

What is a Death Cross?

We’ve touched on a bullish signal with the Golden Cross. Now we’re going to talk about the bearish Death Cross.

It is so named as the formation looks like an ‘X’ on the charts.

A Death Cross occurs when the 50-day Moving Average (MA) falls below the 200-day MA. This signal is usually a sign of a significant downward move.

This signal is usually accompanied by high volume and the long-term moving average becomes the new resistance level in the rising market.

The higher the trading volume the more significant the Death Cross.

When all four major US averages, NASDAQ, Dow, S&P 500 and the Russell 2000, fall into a Death Cross simultaneously, they are generally referred to as the “four horsemen of the apocalypse”.

This could lead to another very bearish chart formation: The Hindenburg Omen.

What then is a Hindenburg Omen?

It was created by a blind mathematician Jim Miekka in 1995. Tragically he died in a traffic accident in 2014, aged only 54.

The Omen is far more serious than a straight Death Cross.

It is named after the infamous airship disaster in the 1930s.

It is created by analysing the number of stocks that form 52 week highs relative to the number of 52 week lows.

It is calculated by dividing the number of high stocks and low stocks by the total number of trades on that day, smoothed by an appropriate exponential moving average.

The high-low index is considered bullish if it is positive and rising and bearish if it is negative and falling.

From an article by John McClellan on the criteria for the Omen to be triggered:

- Both NH and NL must exceed 2.8% of the sum of Advances plus Declines (unchanged issues ignored) on the same day.

- The NYSE Comp (NYA) must be above its value of 50 trading days ago (a conversion from a weekly MA rule to a rule befitting daily data).

- Once initiated, the signal is valid for 30 trading days, and any additional HO signals during those 30 TD should be ignored.

- The signal is activated (i.e. go short) whenever the McClellan Oscillator is negative, and deactivated whenever the McClellan Oscillator is positive (within the 30 TD window).

Does it work?

The indicator has flashed disaster with some degree of accuracy. Since 1985 every US market crash has been proceeded by this omen or signal. However not every flashing ‘airship’ has meant the market has crashed, with only a 25% chance. It also seems that all ‘four horsemen of the apocalypse’ must be flashing disaster at the same time for a true Hindenburg moment.